Rajan Sehgal, IFS

Chairman-Cum-Managing Director

- PERSONS WITH DISABILITIES

The Constitution of India acknowledges the significance of work and employment in Article 39 of the Directive Principal which mandated the State to ensure that the citizen, men, women equally, have the right to an adequate means of livelihood. Also, Article 41 requires that the state shall within the limits of its economic capacity and development makes effective provision for securing the right to work and Article 42 requires that the states shall make provision for securing just and humane condition of work. The above are also applicable for Persons with Disabilities (PwDs). PwD means a person suffering from not less than 40% of any defined disability as certified by a Medical Authority.As per 2011 Census, there are 26.8 million Persons with Disabilities in India. 14.99 million are males and 11.82 million are females with disabilities. It may be seen that 18.63 million PwDs resides in rural area while 8.18 million resides in urban area. As per the data available, about 13.4 million (8.8 million in rural India and 4.6 million in urban India) PwDs are in employable age group. Out of this 13.4 million PwDs in employable age group, 7.8 million are male and 5.6 million are females. Also, out of the total PwD population, 14.6 million are literate. It shows that PwDs is a large pool of human resource whose potential to contribute towards economy of the country cannot be ignored. In order to cater to this large segment of society, the Government of India established National Handicapped Finance and Development Corporation for specific task of making available concessional credit to PwDs and other aspects of economic empowerment.

- ABOUT THE CORPORATION

National Handicapped Finance & Development Corporation(NHFDC) is a not for profit company incorporated on 24th January, 1997 under Section 25 of the Companies Act, 1956(section 8 of companies Act, 2013), working as an Apex Corporation for the benefit of Persons with Disabilities (PwDs)/Divyangjan. NHFDC is wholly owned by Govt. of India and has an authorized share capital of Rs.499.50 crore and paid up share capital of Rs.399.07 Crore. NHFDC has a registered office in Faridabad and corporate office in Delhi.

The main objectives of the Corporation are as under:-- a) Promote economic development activities and self-employment ventures for the benefit of Persons with Disabilities.

- b) Extend loan to the Persons with Disabilities for upgradation of their entrepreneurial skill for proper and efficient management of self-employment ventures.

- c) Extend loan to Persons with Disabilities for pursuing professional/technical education leading to vocational rehabilitation/self-employment.

- d) To assist self-employed Persons with Disabilities in marketing their finished goods.

- SCHEMES & PROGRAMMES OF THE CORPORATION

Credit Based:

(a) Self Employment Loans : Here concessional loan upto Rs.25 lakhs is provided to PwD for starting self employment venture at an interest rate of 5 – 8% based on the loan amount. The loan can be repaid within a maximum repayment period of 10 years. Corporation provides financial assistance in form of loan to PwDs for starting any income generating activity like:

- – For setting up small business in Service/Trading sector

- – For agricultural/allied Activities

- – For purchase of vehicle for commercial hiring

- – For setting up small industries unit

- – For self-employment amongst persons with Mental Retardation and Autism. loan through legal guardian

- – Purchase and/or fitment of any assistive device(s)/customization /retrofitting or conversion of available machine, equipment, vehicle to disabled friendly mode

- – Construction or modification of business premises

(b) Education Loan : The highly concessional education loan is provided to interest PwDsstudents for pursing higher studies at an interest rate of 4% p.a. only. An amount of upto Rs.10 lakhs for studies in India and upto Rs.20 lakhs for studies abroad can be availed by disabled students. The loan can be repaid within a maximum repayment period of 7 years. The repayment of loan starts one year after completion of course or six months after securing a job whichever is earlier.

Eligible Courses

- – All courses having employment prospects are eligible.

- – Graduation courses/ Post graduation courses/ Professional courses

- – Other courses approved by UGC/Government/AICTE etc.

Expenses considered for Education loan

- – Fees payable to college/school/hostel

- – Examination/Library/Laboratory fees

- – Purchase of Books/Equipment/Instruments/Uniforms

- – Caution Deposit/Building Fund/Refundable Deposit (maximum 10% tution fees for the entire course)

- – Travel Expenses/Passage money for studies abroad

- – Purchase of computers considered necessary for completion of course

- – Cost of a Two-wheeler upto Rs. 50,000/-

- – Any other expenses required to complete the course like study tours, project work, Assistive devices etc.

(c) Assistive Devices: Concessional loan upto Rs.5.00 lakh is provided to purchase any assistive devices/vehicle to enhance the Employability or increased Opportunity of Self Employment of Persons with Disability . Main Purpose of this scheme-

- i) for purchase of assistive devices like screen reader, motorized tricycle, scooty, hearing aid etc. to enhance their employability/improve the prospects of self employment.

- ii) Cost of retrofitting/conversion of available machine, equipment, vehicles etc. to disable friendly mode, their adaptation and use by PwDs may also be included in the cost for financial assistance by NHFDC.”

(d) Micro Finance: Purpose of the loan is to provide financial assistance to weaker section of PwD population for starting or augmenting income generation activities. The scheme is mainly implemented through the NGOs. An NGO can avail loan upto Rs.10 lakhs for further disbursement to PwDs and a PwD can avail a maximum of Rs.50,000/- as micro finance loan. As such one NGO can assist 20 PwDs. The rate of interest is upto 5% p.a. only. The loan is to be repaid within a maximum repayment period of 3 years.

(e) Loan for Institutions working for PwDs:Scheme for Parents Association for the Mentally Retarded Persons – Loan uptoRs. 5.0 lakh. Also, loan is available for capacity building of NGO’s working for the PwDs to start any self-employment activity by involving PwDs.

- Non-Credit Based (Grants)

(a) Skill Training of PwD: Under the scheme NHFDC provides grants for the skill training of PwDs. NHFDC follows MSDE guidelines in implementation of skill training programmes.

Skill upgradation is essential for successful running of an organization/vocation in the competitive market conditions. Hence, special emphasis is attached to Skill & EDP training of the target group.

Financial assistant in the form of grant is provided to State Channelising Agencies/reputed institutions for imparting training to the disabled persons (15-50 year of age with 40% or more disability) to make them capable and self-dependent through proper technical training in the field of traditional and technical occupations and entrepreneurship. During the training stipend is also provided to disabled trainees.

(b) Publicity & Awareness Creation: NHFDC provides small grants for publicity of the scheme of the corporation to its implementing agencies.

(c) Incentives to Implementing Agencies: to encourage the implementing agencies to cover more PwDs and make good recovery, NHFDC provides incentives @0.5% to its implementing agencies.

- ELIGIBILITY CRITERIA FOR LOAN UNDER NHFDC SCHEME

- Any person with disability who fulfills the following criteria is eligible to apply for financial assistance under NHFDC scheme through implementing agency –

- – Any Indian Citizen with 40% or more disability.

- – Age above 18 years.

- – Relevant educational/technical/vocational – qualification/experience and background.

Note:

* In case of persons with mental retardation, age is relaxed to 14 years in place of usual 18 years.

** In case of Education loan only (a) is applicable.Repayment Period : (Loan Scheme)

a) Scheme for self-employment – Maximum 10 years

b) Scheme for Education loan – Maximum 7 years

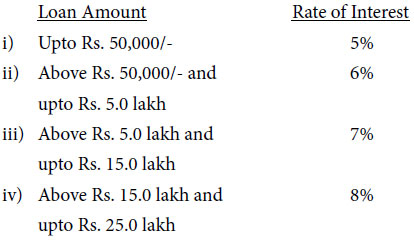

c) Micro Credit scheme – Maximum 3 yearsRate of Interest: (Loan Scheme except Education loan)

Rebate:

i) A rebate of 1% on interest is allowed to women with

disabilities under self-employment loans.

ii) A special rebate of 0.5% is also available for PwDs under VH/HH/MR category under self-employment loans.Rate of Interest & rebate (Education loan) :

Upto Rs. 20.00 lakh 4%

Rebate : A rebate of 0.5% on interest is allowed to female students with disabilities in education loan scheme.

- Any person with disability who fulfills the following criteria is eligible to apply for financial assistance under NHFDC scheme through implementing agency –

- IMPLEMENTATION OF LOAN SCHEMES

NHFDC do not sanction & disburse loan directly. NHFDC functions through 35 State Government nominated state channelizing agencies (SCAs). NHFDC has also tied up with 05 Public Sector Banks (PSBs) and 18 Regional Rural Banks (RRBs) to facilitate concessional loans to PwDs. The loan application is required to be submitted to the implementing agency of NHFDC.

The PwDs need to apply at the district office of the SCA or nearest branch of the partner banks for availing the concessional loans from NHFDC. The scrutiny, verification, appraisal etc of the loan application is done by the respective SCA/Bank. The loan is sanctioned as well as disbursed by these partner agencies to the PwDs. NHFDC provides the refinance to the partner agencies/banks.

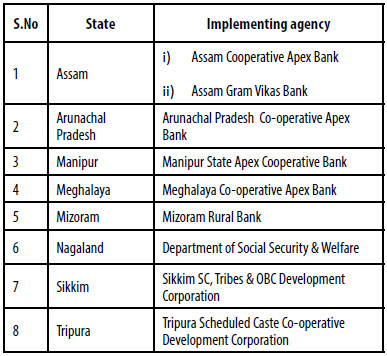

The details of the SCAs and Partner Banks for North Eastern Region are mentioned below:

In additional to above, Punjab National Bank, IDBI Bank, Syndicate Bank, Andhra Bank and North Eastern Development and Finance Corporation ( NEDFi) can also be approached for availing concessional loans under NHFDC schemes.

In additional to above, Punjab National Bank, IDBI Bank, Syndicate Bank, Andhra Bank and North Eastern Development and Finance Corporation ( NEDFi) can also be approached for availing concessional loans under NHFDC schemes. - PERFORMANCE

LOAN DISBURSEMENT: NHFDC has released sofar an amount of Rs. 987.83 crore to implementing agencies for further disbursement of loan to 1,65,339 Persons with Disabilities for self-employment and higher education across the country.SKILL TRAINING: Till date, the Corporation has organized 2761 EDP/skill development trainings in 31 states/UT covering 72832 persons with disabilities.

For further details on NHFDC schemes are available on our website www.nhfdc.nic.in.

- THE WAY AHEAD – NEW INITIATIVES

NHFDC has been traditionally providing its support in the form of concessional loans to PwDs through SCAs and partner banks. Skill training of the target group has been another line of activity being undertaken to help the PwDs, in the last few years. To rapidly enhance the coverage of NHFDC schemes for the socio-economic upliftment of PwDs, the Corporation has undertaken new initiatives, some of which are indicated in the succeeding paras.(i) Opening new avenues of self employment for PwDs

NHFDC continues to explore and provide viable customized models of self employment which can be easily adopted by the interested PwDs.While stand alone self employment activities envisaged by PwDs will continue to be supported through partner agencies, in order to rapidly increase the coverage, the Corporation has also started identifying viable business niches with backward/forward linkages to the established businesses, which can be financed to the group of interested beneficiaries. These include:

Tie-up with Taxi Aggregators

There is the envisaged tie-up with few taxi aggregators providing safe cabs for women & children in NCR and to be gradually expanded to Indore, Jaipur and other cities so that the loan repayment and sustenance of the PwD may be easier. In this model-

- The cab aggregators will give requirement of vehicles along with specifications

- NHFDC will identify interested PwDs for self employment

- NHFDC will facilitate loans to the interested PwDs through Banks/SCAs

- The vehicles will be leased out to these organizations by the interested PwDs

- Organizations will operate these vehicles and make monthly payment of agreed lease amount to PwDs.

- Bank/SCA will deduct the loan installments from the PwD account through ECS.

- The maintenance, insurance and driver will be borne by the operating organizations.

- The PwD beneficiary will have the full liberty to exit out of the arrangement.

- NHFDC will also be extending support to thee organizations in marketing.

The above arrangement will have the following advantages:

- Assured marketing to the PwD loanee

- Greater prospects of scaling up the activity and growth

- Social benefit of availability of safe cabs for women/children/senior citizens/PwDs

- Women empowerment as these cabs will be driven by the women drivers.

- Greater visibility of NHFDC through the financed cabs running across the NCR.

Establishing mini outlets of organized Food Chains

NHFDC is attempting for a tie-up with organized Food Chain Operators like CCD, where the vending machines and consumables will be provided by the company alongwith training to operate the machines. NHFDC will provide the loan support for establishing these mini outlets throughout the country. NHFDC will also tie up with various establishments like petrol pumps, colleges, stations and canteens for providing space to the PwDs to establish the outlets.The cost of the vending machine is around 3.5 lacs but under the tie-up these machines will be provided free of cost on providing some cash deposit as security. The consumables like coffee beans, sugar, milk, tea, cookies, snacks etc will be provided by the CCD on credit basis. The PwD need to install refrigerators, billing machine, counter, sitting space etc. for which NHFDC will provide the loan support.

Establishing Market Support for the Products and Services

Realizing that the non-joint efforts of PwDs in marketing their individual products may not reap in desired benefits and a common marketing platform with a brand is the need of hour in the competitive environment of today, NHFDC is attempting to move beyond just the sponsorship of PwD beneficiaries in major Exhibitions/Fairs to facilitate marketing of their products. NHFDC will support the PwD entrepreneurs in marketing their goods and services by aggregation of their products and services through but not restricted to the exclusive outlets, dedicated stalls in prominent exhibitions, online marketing, etc. The broad framework of the initiative is explained below:

After receipt of intent from PwDs for market support, a suitable selection committee/consultancy firm/individual with specialization in such marketing of PwD products shall shortlist the PwDs and products for marketing. The products and services will be categorized in the following heads:

- Products /Services ready for marketing

- Products/Services require up gradation in terms of quality and standardization

- Products/Services as per the requirement of the market need diversification

- Requirement of Credit linkage for higher production for marketing

After selection of products and services the support in the form of following will be made available

- Development of a professional product catalogue under various categories

- A dedicated marketing team will be developed for procuring bulk orders

- Development of logistic chain of small warehouses for cost effective marketing

- Tie-ups with corporate houses/super stores for continuous and long term marketing of products and services

- Tie-ups with online marketing portals for marketing under common brand

- Development of product development team for improving the quality of the products and introducing the new products of PwDs.

(ii) Expansion of Skill training activities

It is a fact that a well trained person has more chances to be a successful entrepreneur. Corporation currently arranges training of around 20-30,000 PwDs annually through various partners. The bouquet and the reach is being expanded by co-opting state channelizing agencies as partners in establishing and running of in-house skill training centres. The thrust of the training modules will be gradually diverted to selected trades with visible business/job opportunities.

Expanding the existing Skill Training Centers into Incubation Centers

Training-cum-Incubation Centres provide an opportunity to first generation entrepreneurs to acquire skill for enterprise building and also incubating them to become successful small business owners. At these centres, exposure in all areas of business operations are provided such as business skills development, hands on experience on working projects, opportunity guidance including commercial aspects of business. NHFDC has started discussions with the NSIC in order to upgrade the existing skill centers of the corporation into Incubation Centres. NHFDC has identified activities like Socks Making, Paper Cup Plate Making and Tissues/Paper Napkins Making etc. to begin with at Faridabad Skill Training Center. The establishment of the above live models of these activities will not only provide hands on experience to PwDs in production and marketing but will also provide an opportunity to the PwDs to procure raw material and do the production activity of his/her own for real time business model before venturing into full fledged self-employment.

Introducing Online Skill Trainings for PwDs

In order to provide an opportunity to pick up skills like Online Marketing, Hand Embroidery, Tally and Banking, Cooking and online marketing etc NHFDC would like to introduce these courses on trial basis from the two skill learning centers in Ujjain and Faridabad. The PwD will learn online from the comfort of their home and will have the option to come to the NHFDC center for clarity.

(iii) Wage Employment Initiatives

Job Fairs for PwDs

NHFDC has initiated discussions with National Career Service Center for PwDs (erstwhile VRC) for organizing Job Fairs for PwDs for the gainful employment in private companies. To begin with NHFDC has already conducted one Job Fair in New Delhi on 3rd July 2019 and also scheduled one at Guwahati on 12.07.2019.

Concerted Efforts for the placement of Hearing Impaired PwDs

NHFDC in association with ETPs has zeroed on courses like Retail Sales Management and Tally for imparting at various locations. The trained PwDs will be absorbed in retail brand shops/chains especially as cashiers at cash counters.

(H) Establishing NHFDC CSR Foundation

Corporation has recently taken decision to establish its CSR Foundation and many of the above initiatives will be supported by the Foundation. In the process, NHFDC wishes to enhance its role in the process of economic empowerment of PwDs from that of a passive refinance facilitator to an active provider of backward and forward linkages in the ever expanding Indian economy. The corporation hopes to enhance its reach and business volume with the above initiatives.